- Property Playbook 📘

- Posts

- Gentrification: Good Bad And Ugly

Gentrification: Good Bad And Ugly

We talk about city planning, community impact, and some complexities

Hey guys, it’s Mo –

Sorry about not sending a newsletter last week. I’ve been having some writers block lately and blanked on a topic last week. But not too fear, I’ve got something juicy I’ve been wanting to talk about lately.

Gentrification

City Planning

Community Impact

Navigating Some Complexities Of Gentrification

Gentrification

Gentrification has been on my mind lately as I live in an older neighborhood in the Bay Area zoned for mostly single family residences.

There was a transit hub installed near my house about 5-6 years ago and there are at least 6-7 new townhome and condo complexes being built. There was a new school built to accomodate all of the new developments.

This increased the neighborhood’s value and will bring in tons of economic value as well.

People often scorn at gentrification saying “it drives higher prices and ruins the character of the neighborhood”. Some aspects of those may be true, but gentrification usually starts with the government.

The Role of City-Level Planning in Gentrification

City-level planning plays a pivotal role in shaping the gentrification landscape.

General plans, serving as 20-year blueprints, significantly impact property values and demographic shifts. These plans include aspects like zoning, infrastructure, parks, and public services, which in turn attract real estate interest.

If you’re playing your cards right, you can make a lot of money related to any of it. If you’re in an area where there’s lots of growth, chances are your property value will grow as well.

You don’t need to be a real estate developer to capitalize on this growth too. Any gentrification in the area is usually good long term. If there is new development, it means external capital sources (companies) know a city is investing in and there are usually jobs that are coming, which also boost the city’s economy.

Example –

You can be a retail landlord that can analyze the trends in an area and make sure your tenant base fits the characteristic of a neighborhood.

Say you own a retail plaza near a university town like Tempe, AZ (Go Sun Devils, my alma mater) where there is lots and lots of new developments with high end resort-like amenities. This indicates the tenant base is probably relatively affluent and has mommy and daddy’s credit card where spending won’t be an issue.

If your tenant base is mostly college students from affluent areas, this means that you can have high end coffee shops, more expensive restaurants, nail salons, neighborhood bars, hair salons and a Whole Foods or organic grocery store.

Compare this to a retail plaza in a “C” area which might contain dimly lit liquor stores, check cashing places, pawn shops, dollar stores, and lack of grocery stores.

Case Study: Analyzing a City's General Plan

A deep dive into a city's general plan can reveal upcoming areas of upcoming companies, new developments, and you can use that information along with insider knowledge to make money.

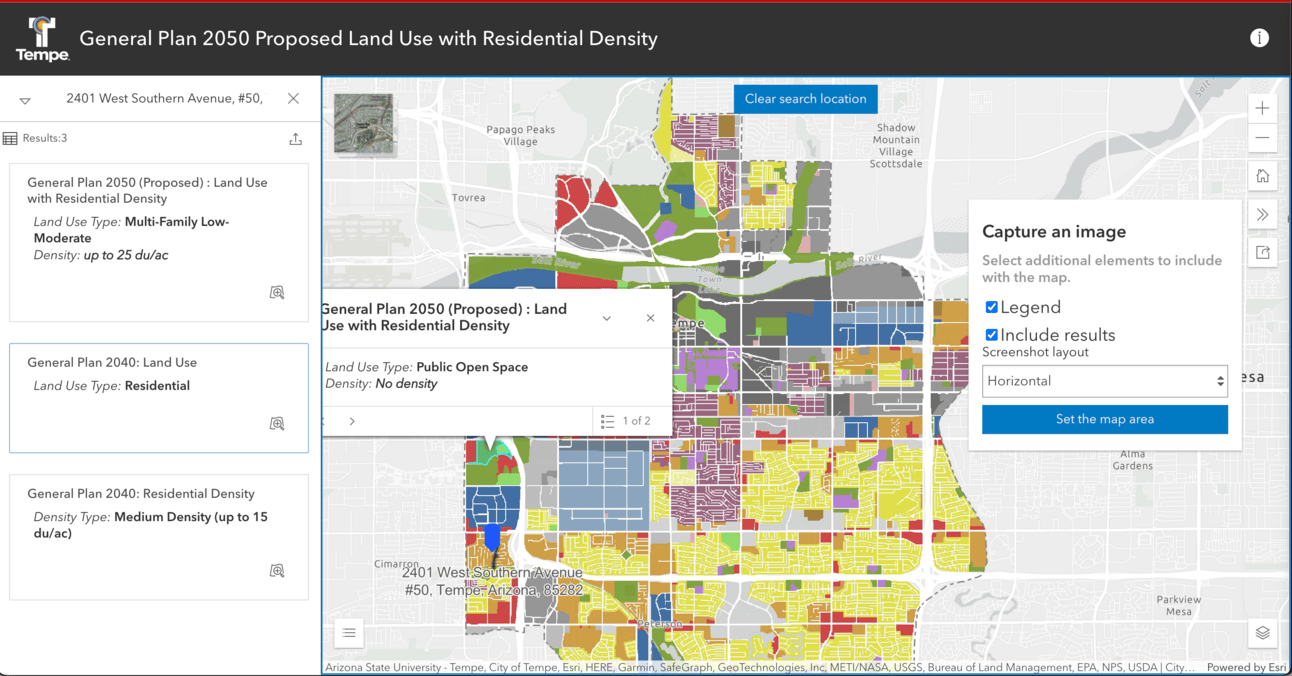

In this screenshot, I pulled up Tempe’s 20 year plan. As you can see where I highlighted, it’s by the West side of Tempe that is publicly open space. If I click around it, it shows Industrial and Commercial.

If you’re a developer, it might mean it’s a good idea to put something that’s conducive to industrial tenants. If you’re a residential landlord, it could mean you should expect tenants to work in manufacturing or logistics industries and have an idea of what their incomes are.

Community Impact

Here's where things get real.

Development isn't just about buildings; it's about people. The arrival of new businesses and residents can bring vitality to a neighborhood, but it can also push out long-time locals.

We need to talk about the delicate balance between progress and preservation. How do we ensure that development benefits everyone?

This is where public hearings from the community occur and developers can hear a community’s feedback and objections to a possible development.

Not all developments are bad: in certain cities, there are tax abatements or tax breaks for developers if they set aside a certain percentage of units for affordable housing or if they dedicate a development for affordable housing.

In New York in the 1980’s and 1990’s, developers were notorious for building swanky downtown condos and co-ops, but developing projects in ghettos like deep Brooklyn and Queens.

People who are very vocal against development are known as NIMBY’s or Not In My Backyard. NIMBY’s are a huge problem in areas like LA, NYC, SF, and even Austin (proper).

Navigating the Complexities of Investing in Gentrification Hotspots

Deep-Dive Market Research:

Before diving in, you need a comprehensive understanding of the area. This goes beyond just looking at property values.

It's about understanding the heartbeat of the neighborhood – its history, its people, and its potential future. This means getting to know the local industries, community leaders and their politics, and the demographics of everyday folks who call it home.

Legal and Regulatory Knowledge:

Each gentrifying area has its unique legal landscape. Familiarize yourself with the zoning laws, building codes, and tenant rights specific to the area.

Staying ahead of potential regulatory changes can also give you an edge. Sometimes, it's about being proactive.

Some cities livestream their city council meetings. You can also search to see what grants are being offered from governments or private organizations. This would indicate bigger picture visions.

In Cleveland for example, there was a $5k grant for homeowners to remove asbestos and lead based paint from their exteriors. The big picture concept was they wanted houses to be updated and safe.

Building Relationships and Trust:

It’s very important to understand the dynamics in a gentrifying neighborhood. If you’re a developer that wants to propose a large multifamily project, you’re going to have to get the buy-in from local community leaders like the mayor and convince the public it’s a good thing.

If you’re an employer that’s looking to build a factory in a town, you’re going to have to convince the local leaders you won’t pull out if costs rise up.

The Rust Belt is a perfect example of what happens when a city is too reliant on one company or one industry.

Long-Term Vision:

Finally, think long-term. '

Gentrification is a process, not an event.

Your investment should not only look good on paper today but should also contribute to the sustainable growth of the area in the years to come.

Are you bullish on an area because of an offhand announcement or is there significant data to back it up.

Imagine if you invested in Austin in 2008 when it was a small little suburb. Fast forward to 2022 and it’s the hottest city where everyone is moving to. Austin was originally known to “keep it weird”, but now it’s the tech corridor of TX with tons of jobs moving in.

Tech was the original moving force, but now Tesla has created a factory and there are many more companies moving in. This in turn is creating other towns and other industries to support the initial wave of people moving in.

Conclusion

And that's the real deal about investing in gentrifying areas.

It's not just about spotting the next big trend or crunching property values. It's about really getting into the nitty-gritty of a neighborhood – understanding its pulse, its people, and its potential.

Whether you're looking at city plans, zoning laws, or chatting up the locals, it's all about piecing together the bigger picture. Remember, it's a long game.

Today's decisions shape tomorrow's communities. So, as you navigate these exciting, often unpredictable waters of real estate, keep that long-term vision sharp.

Let's not just make money, let's make a difference. Here's to making smart, impactful investments that stand the test of time and bring real value to our communities.

Thanks for making it to the end of this newsletter. Catch you in the next newsletter – until then, keep learning!

Cheers,

Mo